US employer health plan enrollment up 2% under PPACAfs

dependent eligibility rule

US

New York City, 1 August 2011

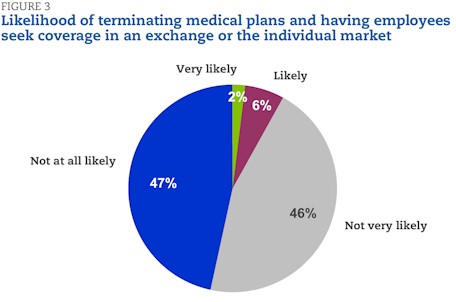

- Despite concerns about cost, just 2% of respondents say they are gvery

likelyh to terminate medical plans after the insurance exchanges are

operational, with another 6% glikelyh to do so – essentially unchanged from a

year ago.

- Excise tax remains the reform provision that concerns the most

employers.

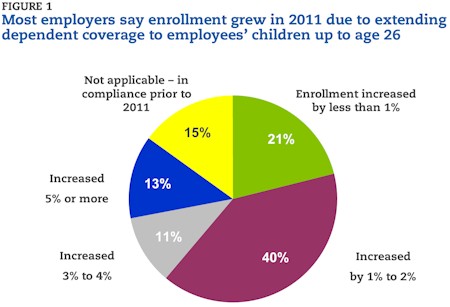

In just over a year since the passage of the Patient Protection and

Affordable Care Act (PPACA), employers have already felt its effects, with an

average 2% increase in enrollment as they extended eligibility for dependent

coverage to employeesf children up to age 26 (Fig. 1). According to a survey of

nearly 900 employers released today by Mercer, PPACAfs rule requiring employers

to automatically enroll newly hired, or newly eligible, full-time employees into

a health plan will cause enrollment to grow by another 2% on average in 2014,

when the provision is slated to go into effect.

gEmployers have already been facing average increases in per-employee health

benefit cost of about 6% annually for the past six years,h said Tracy Watts, a

consultant in Mercerfs Washington, DC, office. gAdding enrollment growth on top

of that puts a real strain on their budgets.h

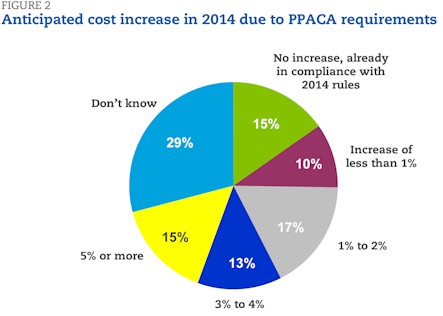

Mercer surveyed 894 employers last month about whether they expect PPACA

rules will cause costs to rise in 2014, and if so, by how much. More than a

fourth of respondents (28%) said that compliance with PPACA mandates slated to

go into effect in 2014 – most significantly, extending coverage to all employees

working on average 30 or more hours per week, auto-enrolling new full-time

employees and ensuring that plans pay for at least 60% of covered services –

will add at least another 3% to their projected 2014 plan costs, with 15%

expecting an additional 5% or more. About the same number (27%) predict a

relatively modest increase of 2% or less, and 15% said their plans were already

in compliance and would see no cost increase. The remaining 29% could not

estimate the impact (Fig. 2).

Despite concerns about cost, employers remain committed to offering medical

coverage to their employees. Just 2% of survey respondents say they are gvery

likelyh to terminate medical plans after the insurance exchanges are

operational, with another 6% glikelyh to do so (Fig. 3). Mercer asked the same

question in a survey of more than 2,800 employers conducted a year ago, just a

few months after health reform was signed into law, and employersf opinions on

this question are essentially unchanged. g

Employers have spent the past year studying the new law and developing

strategies to deal with the increased costs and administrative burdens,h said

Beth Umland, director of research for health and benefits for Mercer. gBut they

donft seem to have changed their minds about the value of continuing to offer

their employees health coverage.h

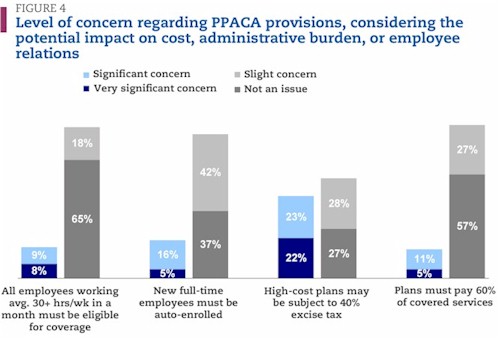

Employersf #1 concern: Excise tax on high-cost plans

A year ago, Mercer asked employers about their level of concern over six

major provisions of PPACA, a question that was repeated in the current survey.

The excise tax on high-cost plans, which is slated to take effect in 2018,

emerged as their top concern then and remains their top concern today – even

though it will not be implemented until 2018. The excise tax poses a gvery

significant concernh for 22% of the survey respondents and a gsignificant

concernh for an additional 23%. About a fourth (28%) say itfs only a gslight

concernh and a similar number (27%) say itfs gnot an issueh for their

organizations (Fig. 4).

gThere are reasons other than richness of benefits that drive up cost, such

as having an older population or being located in a high-cost metropolitan area

– both factors that are not under an employerfs control,h said Ms. Watts. gAnd

employers that rely on generous medical benefits to help attract and retain top

employees are also going to be concerned about an excise tax.h

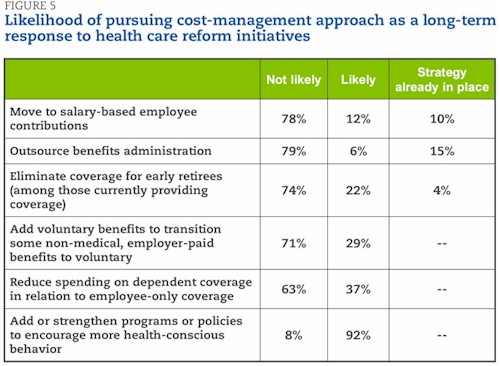

The excise tax provides employers with a strong incentive to keep health plan

cost down. Their top long-term cost management strategy is to add or strengthen

programs or policies to encourage more health-conscious behavior – 54% say they

are very likely to pursue this strategy while another 38% say they are likely to

do to (Fig. 5).

gBecause the excise tax is based on the total cost to cover an individual or

a family, employers canft avoid reaching the tax threshold simply by shifting

cost to employees. Improving employee health is a way to lower the total cost of

health care,h said Ms. Watts.

Another way to reduce plan cost is to carve out various non-medical benefits

such as dental and vision and offer them to employees as voluntary benefits.

Over a fourth of respondents (29%) say they are likely to take this

approach.

But, as enrollment levels climb, some employers are considering ways to

control their own spending on health benefits through other means. Nearly

two-fifths (38%) say itfs likely or very likely that they will reduce their

spending on dependent coverage in relation to employee-only coverage. gSmall

employers already typically contribute significantly less to the cost of

dependent coverage than employee coverage, but with the growth in dependent

enrollment, more large employers may move in this direction as well,h said Ms.

Umland.

Of the largest survey respondents – those with 5,000 or more employees – 45%

are likely to reduce spending on dependent coverage, compared to 30% of those

with fewer than 500 employees.

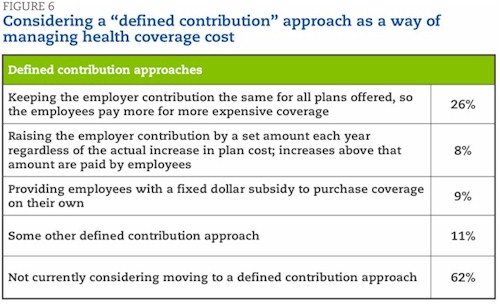

And some employers are considering moving to some type of gdefined

contributionh approach to paying for health coverage. More than a fourth of

respondents (26%) say they are considering keeping the employer contribution the

same for all plans offered, so that employees pay more for more expensive plans

(Fig. 6). Fewer (8%) are considering raising the employer contribution by a set

amount each year, regardless of the actual increase in cost, with employees

absorbing the rest of the increase, or simply providing employees with a fixed

dollar subsidy to purchase coverage on their own (9%).

Auto-enrollment will have the biggest impact on the largest employers

Of the employer-related reform provisions slated to go into effect in 2014,

auto-enrolling new full-time employees seems to be causing the most headaches.

Auto-enrollment is seen as a gvery significanth or gsignificanth concern by

about a fifth of all respondents (21%), but by 28% of those with at least 5,000

employees.

Employers are already considering how to manage the cost of the

auto-enrollment requirement. Among survey respondents that currently offer only

one medical plan, while most will simply use their current plan as the default

plan for auto-enrolling new full-time employees, 10% say they will add a new,

lower-cost plan to use as the default plan and 3% will change to a new,

lower-cost plan for all employees. Among those respondents that currently offer

a choice of medical plans, 65% will use their current lowest-cost plan as the

default plan; 29% will use their standard plan (the plan with the highest

enrollment) and 7% will add a new plan as the default for auto-enrollment. The

largest employers – those with 5,000 or more employees – are the most likely to

add a new plan (11%).

gAdding health plan enrollees has such a significant impact on cost that itfs

easy to see why employers accustomed to about a 15% opt-out rate are concerned

about auto-enrollment,h said Ms. Watts. gBut itfs difficult to predict how

employees will react once they weigh the amount of money that will come out of

each paycheck if they enroll against the tax penalty for not obtaining

coverage.h

Retailers particularly concerned about cost of covering more part-time

workers

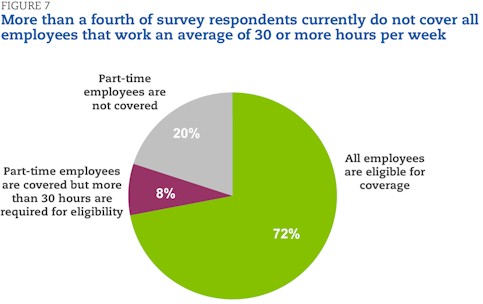

The rule that employers must offer gaffordableh coverage to all employees

working an average of 30 hours or more a week in a month (or else be subject to

penalties) is a very significant or significant concern for just 17% of all

respondents, but for 37% of those in the wholesale/retail industry, which relies

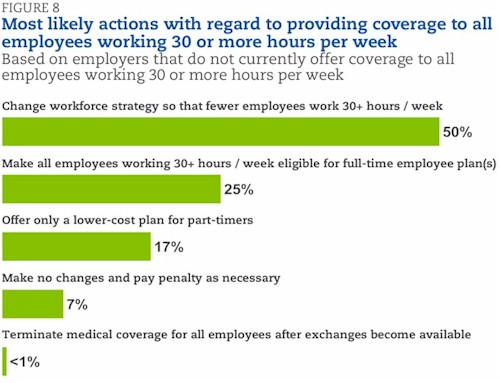

heavily on part-time labor. Among the 28% of respondents that have part-time

employees but currently do not offer coverage to all employees working 30 or

more hours per week (Fig. 7), one-half say that they are most likely to change

their workforce strategy so that fewer employees work 30 hours or more a week.

One-fourth are most likely to make all employees eligible for the current

full-time employee plan, while 17% will offer only a lower-cost plan to

part-timers. Only 7% say they would seriously consider making no or minimal

changes to increase the number of eligible employees and instead pay the

required penalty. No respondents thought they were likely to terminate employee

health plan coverage as a result of this new rule (Fig. 8).

About the survey

The survey was conducted in June 2011. Invitations to complete the online

questionnaire were sent to the organizations that participated in Mercerfs

National Survey of Employer-Sponsored Health Plans, which used a national

probability sample of private and public employers; 894 employers completed the

survey.

About Mercer

Mercer is a global leader in human resource consulting, outsourcing and

investment services. Mercer works with clients to solve their most complex

benefit and human capital issues by designing, implementing and administering

health, retirement and other benefit programs. Mercerfs investment services

include investment consulting, implemented consulting and multi-manager

investment management. Mercerfs 20,000 employees are based in more than 40

countries. The company is a wholly owned subsidiary of Marsh & McLennan

Companies, Inc., which lists its stock (ticker symbol: MMC) on the New York and

Chicago stock exchanges. For more information, visit http://www.mercer.com/.

©2011 Mercer LLC, All Rights

Reserved